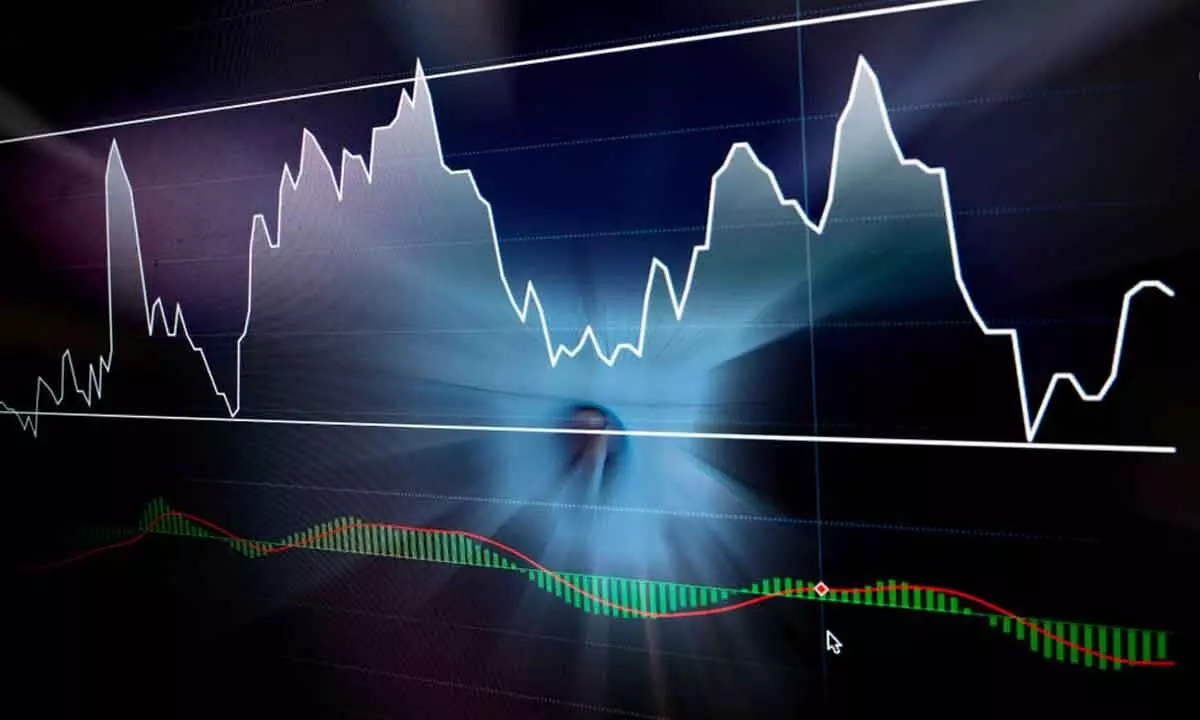

MACD histogram signals bullish momentum

The stock market has recovered and continued the rally after a weak opening.

image for illustrative purpose

The stock market has recovered and continued the rally after a weak opening. The frontline index, Nifty up by 62.05 points and closed at 16340.55. Only Pharma and Media indices are down by less than half per cent. The Realty and the PSU Bank indices are the top gainers with 2.55 per cent and 2.29 per cent, respectively. The Bank Nifty and Auto indices gained by a percentage. The other indices are up by less than a per cent. Overall market breadth is positive as 1170 advances and 705 declines. About 44 stocks hit a new 52-week high, and 114 stocks traded in the upper circuit. Reliance, HDFC Bank and ICICI Bank are the top trading counters in terms of value.

The Nifty closed above the prior day's high. After opening with a negative gap, the index recovered the losses in the first hour itself. There was a brief pause in the afternoon session, but, with a strong move, the index closed at its high. The 78.6 per cent retracement level is just another 100 points away. Interestingly, the 78.6 per cent retracement level and the 100 EMA are at the same level of 16449. The Nifty may face strong resistance at this level. Let us wait and see the price behaviour near this zone.

The RSI has reached the highest level, above 60, and entered the strong bullish zone. The MACD histogram inched up further and signaled the bullish momentum. A majority of the sectors recovered from the low is a positive sign. The Nifty IT index is showing some positive divergences and improving relative strength. As Rupee depreciates by over Rs80, the IT and export oriented stocks may benefit from this. The real concern, for now, is that the RRG Relative Strength is still not improved. The Anchored VWAP resistance is at 16353. In any case, a close above 16353, the next level of resistance is placed at 16449. The next 100 points rally and the behaviour at this zone is important for the Nifty.

(The author is Chief Mentor, Indus School of Technical Analysis, Financial Journalist, Technical Analyst, Trainer and Family Fund Manager)